FINCITY is a team of professional executives trained on a complete range of TAX and IT Solutions. We have been providing VAT Consulting,Accounting System Set up & Training,Bookkeeping & Accounting,Audit Support, Software & IT support, Back Office Support etc.

We work beside you to analyse your projects from both a financial and market perspective to give you clarity and transparency for sound decision making.

A business must register for VAT if their taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. Furthermore, a business may choose to register for VAT voluntarily if their supplies and imports are less than the mandatory registration threshold, but exceed the voluntary registration threshold of AED 187,500. Similarly, a business may register voluntarily if their expenses exceed the voluntary registration threshold. This latter opportunity to register voluntarily is designed to enable start-up businesses with no turnover to register for VAT.

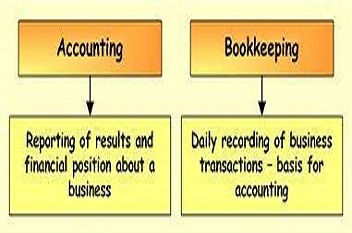

All businesses in the UAE need to record their financial transactions and ensure that their financial records are accurate and up to date. Businesses that meet the minimum annual turnover requirement (as evidenced by their financial records) are required to register for VAT. Businesses that do not think they should be VAT-registered should maintain their financial records in any event, in case we need to establish whether they should be registered.Any records related to a real estate required to be kept shall be held for a period of 15 years after the end of the Tax Period to which they relate.

If you are a VAT-registered business you must report the amount of VAT you’ve charged and the amount of VAT you’ve paid to the government on a regular basis. It will be a formal submission and it is likely that the reporting will be made online. If you’ve charged more VAT than you’ve paid, you have to pay the difference to the government. If you’ve paid more VAT than you’ve charged, you can reclaim the difference.A Tax Return must be received by the Authority no later than the 28th day following the end of the Tax Period concerned or by such other date as directed by the Authority.

VAT enabled accounting software that lets generate invoices, reconcile bank transactions, manage expenses, track inventory and generate insightful reports effortlessly.

Our Social media experts possess the right attitude to attain the best tool to acheive the goal.This helps to enhance the If managed your brand visibility.

We Create Beautiful,Innovative & Handcrafted Websites & Build Strong Relations With Effective Ecommerce Solutions,that helps to enhance the business.

Meet with us to success your dream business.

happy customers

Project complete

World Wide Branch

Professional Experience