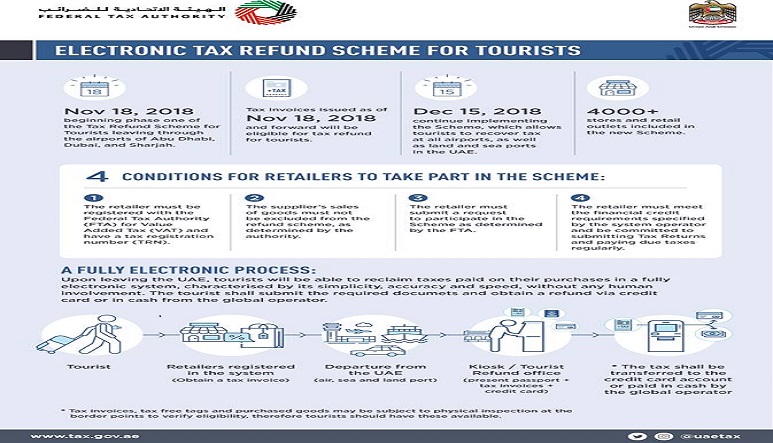

The FTA has announced that the tax refund scheme for tourists will take its effect from November 18, 2018.

As the FTA’s director general has mentioned, more than 4,000 retail outlets across the UAE will be connected electronically to the system, allowing eligible tourists to request refunds of value added tax (VAT) incurred on their purchases. It is required that the minimum amount spent for a tax refund is Dh250. Tourists may claim the refund within 90 days of their purchase.